Why Academic Biobanks Accelerate Research That India Actually Needs

India’s genetic diversity is one of the richest in the world. Populations vary across regions, ethnicities, and socio-cultural groups. Yet this diversity remains under-represented in global datasets, limiting the development of targeted diagnostics and personalized therapeutics.

Majority of global biobank biospecimens are of European ancestry, severely underrepresenting Indians. Since genetic variations affecting disease risk, drug response, and metabolism differ across populations, diagnostics and medicines developed mainly from European data often work sub-optimally, or even unsafely, for Indian patients.

So how do we bridge this genetic diversity gap?

And perhaps more importantly—why hasn’t it been filled already?

The challenge lies not in awareness, but in infrastructure and integration. Building a biobank requires more than freezers and laboratories—it demands a rare convergence of clinical access, research capability, ethical frameworks, and long-term institutional commitment. Most research institutions lack direct healthcare networks, while hospitals often lack research infrastructure. This structural disconnect has kept India’s genetic diversity largely unmapped, despite housing 17% of the world’s population.

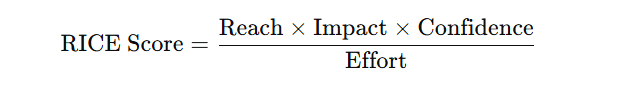

Biobanks can fill this gap by systematically collecting and curating bio-specimen from across the population. Such datasets enable:

- More accurate disease risk prediction

- Region-specific biomarker discovery

- Better understanding of lifestyle–gene interactions

- Improved precision medicine for Indian communities

SSSBRH: The unique advantage of an integrated ecosystem approach.

The Sri Sathya Sai Biobank and Research Hub (SSSBRH) goes a step further by embedding biobanking within a full research-to-clinic ecosystem.. Unlike traditional biobanks that operate in isolation, SSSBRH brings together three critical pillars under one unified vision:

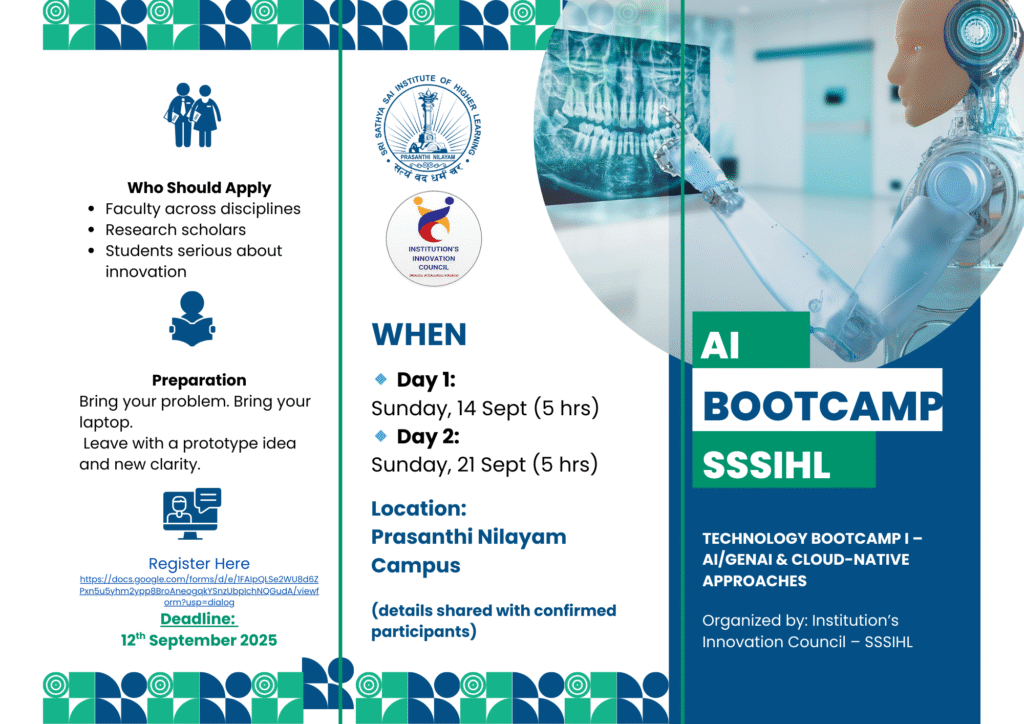

- Academicians from Sri Sathya Sai Institute of Higher Learning (SSSIHL) training the next generation of biomedical scientists with hands-on research experience.

- Innovators and researchers conducting cutting-edge translational studies in state-of-the-art BSL-1 and BSL-2 facilities spanning 50,000 sq ft.

- Healthcare infrastructure through SSSIHMS tertiary hospitals, Sri Sathya Sai General Hospitals, and mobile hospital units that reach remote villages—providing continuous access to diverse patient populations across urban, semi-urban, and rural settings.

Institutional alignment through the Sri Sathya Sai Central Trust, ensuring that education, research, and healthcare all advance toward a shared mission: making precision medicine accessible and effective for every Indian.

This integrated model creates a self-sustaining cycle where education drives research excellence, research enhances healthcare delivery, and healthcare informs future educational priorities. The SSSBRH demonstrates how India can leapfrog traditional biobanking limitations by building complete ecosystems rather than isolated facilities.Academic biobanks like the Sri Sathya Sai Biobank and Research Hub (SSSBRH) in association with SSSIHL possess unique advantages. They integrate three essential pillars:

- Education for training the next generation of biomedical scientists,

- Research enabling cutting-edge translational studies, and

- Healthcare providing continuous access to diverse patient populations.

“This integrated ecosystem creates a self-sustaining cycle where education drives research excellence, research enhances healthcare delivery, and healthcare informs future educational priorities.”

The SSSBRH demonstrates how academic biobanks catalyze translational medicine. Building upon a decade of research, it houses 25,000+ samples including 10,000 antimicrobial resistance bacterial isolates, 5,000 cardiovascular disease specimens, 5,000 infectious disease samples, and 5,000 neuropsychiatric research biospecimens.

Academic biobanks can strategically focus on conditions causing maximum health and economic impact. For communicable diseases, India’s high antimicrobial resistance burden requires dedicated bacterial pathogen collections for surveillance and therapeutic development.

India stands at a crossroads. The country can either develop robust academic biobanking infrastructure to support its precision medicine ambitions, or continue relying on inadequate capacity and external data that doesn’t reflect Indian diversity.

Academic biobanks like SSSBRH demonstrate what’s possible when institutions combine education, research, and healthcare under principles of service to humanity.